Growing up in India, I think most of us have heard of an uncle who used to play with stocks and lost a ton of money. I also heard such stories and I had fully imbibed that buying stocks was as good as gambling. Only reliable sources of investing were fixed deposits, or buying some property like land, house or shop. When I came to the US, buying any property was ruled out, close equivalents of fixed deposits were giving close to 0.5% return. Of course, I did the most sensible thing with whatever money I was saving out of my stipend, I kept it in my bank account earning a handsome 0.01% interest per year. It could increase by 10 times, and I won’t feel a difference!

I never bothered to learn about investing. When anyone used to ask me about investing (after all, I was studying Economics), my response was always, there is a difference between economics and finance, and I don’t study finance (I still believe this response is valid, to be honest). What I did not realize was that I didn’t need to learn about investing because I was studying Economics, but because it was an essential part of understanding money and managing my finances, an essential part of being an adult, some might say.

This started to change around August of 2020. A couple of things started happening around this time. I was just starting my job, and as a part of retirement plans offered by my employer, I had to make calls on how much money I wanted to be deducted out of my paycheck. More importantly, I had to select where that money would be invested in. I could just choose the default place that the broker website recommended to me. But since it was my money which was going here, I thought it would be better to understand where it’s going. A call with a friend’s father (who thankfully, did not believe investing in stocks is gambling) helped clarify things a bit, and he also suggested that the default choice was actually the best one :P. Secondly, a couple of friends were starting to use this investment app called “Robinhood”. Here, one of the strongest forces of our time, FOMO kicked in, and I also installed the app.

I got my free $4 stock as part of opening an account with them. The skepticism was still there, so while friends were putting in $5,000 in their account, I started with a modest $500 balance. Now comes the fun part. Where do I put my $500? I started thinking Apple could be a good option. Everyone keeps buying new iPhones, even if they hardly change anything from the previous year. Apple can sell a microfiber cleaning cloth for $19, and people buy that too. Surely, Apple can’t be going down. I mean, their products are good too :P Anyway, so I bought a couple of shares of Apple at $116 a share. Next day, the price was $112. I was just down $8. I was turning into that uncle whom kids in India would hear about!

At that time, I finally (thankfully!) decided to pick up a book and start learning about all these things. After some Google and YouTube search, I picked up the book, “I will teach you to be rich” by Ramit Sethi. I know the title is click-baity and may inspire some skepticism, but the book is actually very good. There are many things which are US specific such as discussion of different retirement accounts, but the general information is very useful for anyone wanting to learn more.

For me, personally, the book helped in understanding these three things after which I started caring more about investing:

-

The main reason why I was hesitant of the stock market, as you might have figured out by now, was that I was scared of losing my money. It might sound stupid but it actually took me time to realize that you actually don’t lose money until you sell your stock. Just because Apple’s price had fallen the next day, didn’t mean that I had lost $8. This is something that Ramit really tries to hone in. Yes, there can be times when the market goes down, but over time, market has only gone up. I just had to be comfortable with volatility in my account and not sell as soon as something was going down.

Moreover, even though I was scared to lose money, I was actually losing money by keeping it in my bank account. Money in the bank account was not growing fast enough to match inflation. The same $100 could buy me much less than what it could buy me a couple of years ago. In real terms, that is, in terms of buying power, I was losing money.

- I also used to believe that investing was very complicated, that I was no expert and would have no idea what to do. After reading the book, I understood that the most sensible advice was actually very simple. I did not have to know how to pick any stocks. In fact, it was recommended not to pick any individual stocks. The simplest way was to just invest in a fund which tracks a combination of top 500 companies in the US and just keep putting money in it. No need of financial advisers, no need to incur unnecessary fees.

-

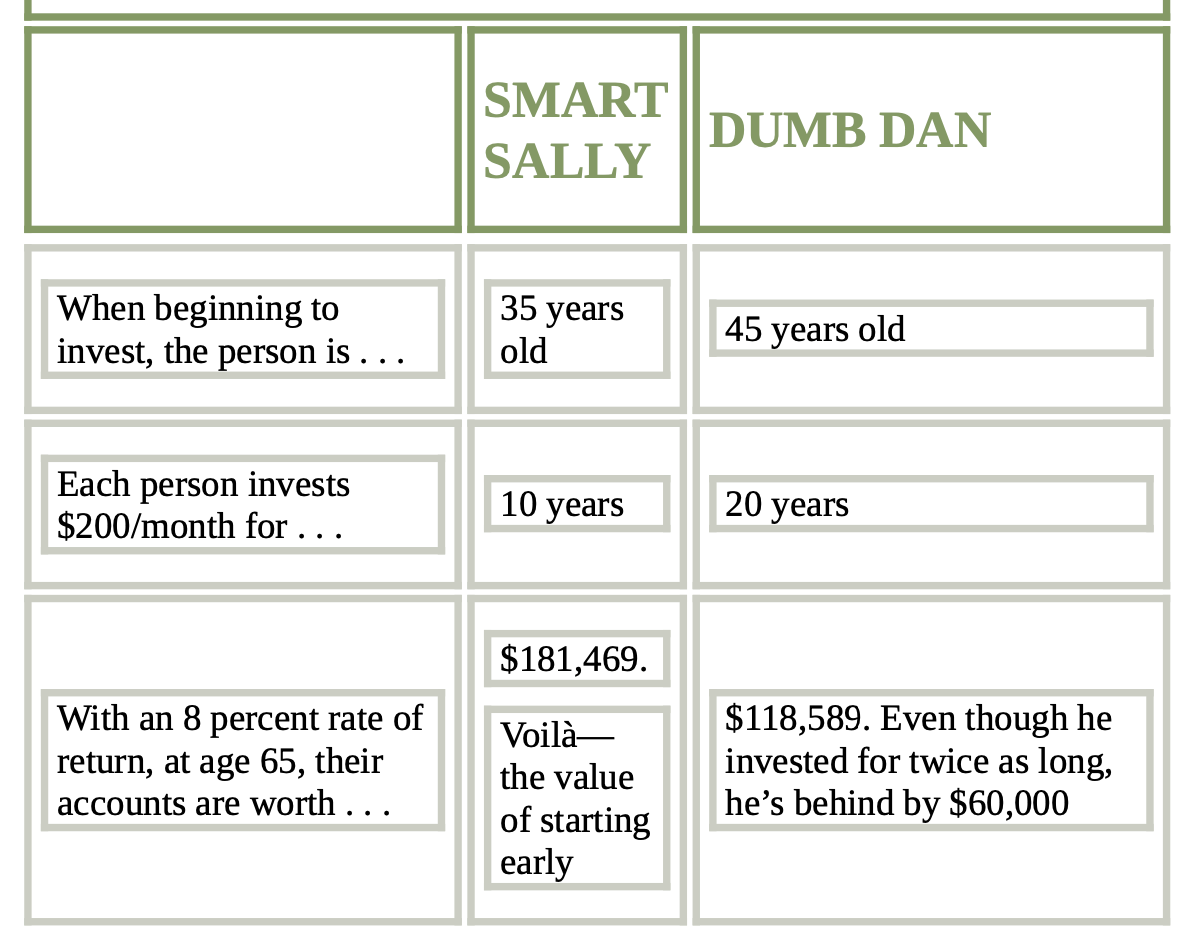

I think probably the biggest revelation was what I was missing out on by not being in the investing game. I had heard about compounding, but wish I had seen some of these examples of compounding earlier. Here is one of these examples:

Here, Sally is 35 when she starts investing money and Dan is 45 when he starts investing. Sally invests $200 per month for 10 years, and stops when she turns 45. Dan invests the same $200 per month for 20 years, so he is investing twice as much money as Sally, but at 65, he still has 33% less money in his account. Compounding can do wonderful things!

I wish at the end of this post, I had some encouraging positive numbers to show regarding how much I have made, but sadly that’s not the case. In fact, I am down 7% on my entire portfolio, even though I was up 15% just 6 months ago, and even 4% up just 4 weeks ago. But that’s the thing with markets, I guess. It hasn’t been up every year. In fact, there have been years (2008-09 among others) when it has been down big as well. I have also made my fair share of mistakes, such as dabbling with individual stocks more than I should have, and I am also learning more as I go along in my investment journey. Hope is that over time, markets will continue to trend up as they historically have and my portfolio will be positive again soon. Fingers crossed!