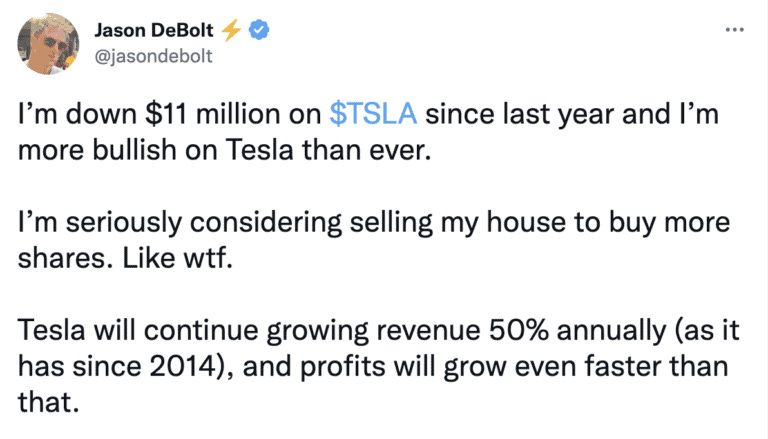

Usually, there are two more common ways to invest in the stock market by yourself (among others): Buying individual stocks like Tesla, Google, Facebook etc. or buying low cost Index Funds which invest money in plenty of these individual stocks. For example, a common index fund is based on the S&P 500 index which comprises of top 500 companies in the US. You could buy a $100 worth of Google stock or you could buy an index fund with $100 to get exposure to all the stocks in that index. Investing in index funds is more of a boring approach while investing in individual stocks can be more exciting. It’s not only the case that the movements in individual stocks prices are relatively higher which makes them more exciting. There is also potential thrill involved in getting things right, finding undervalued stocks which rise up and give you huge returns. If you get it right, it can make you ultra rich like this person:

Jason started investing in Tesla when it was priced at $2.5 only (adjusted for the recent split in shares) and the maximum price Tesla reached was $407 (again, adjusted for the split). These kinds of gains are highly unlikely by investing in index funds.

Despite all their glory, I have learned that for me at least, it makes sense to keep most of my stock market investments in index funds only going forward. Here are my reasons for it:

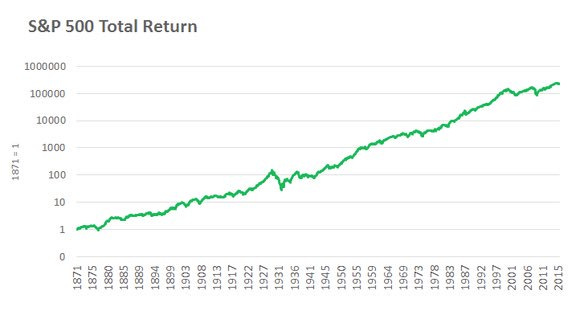

1. Index funds are self cleansing

One reason why I consider index funds to be safer is that the composition of index is always changing. The S&P 500 Index always refers to the top 500 companies in the US. So if some companies are not doing well, they are excluded from the index while other well performing companies are added to the index. Author JL Collins calls it the ‘self-cleansing’ nature of index funds. While the index has gone up over time as can be seen in the picture below (credit: this post by Nick Maggiulli), the composition of the index has changed quite a lot over this period of time.

As Geoffrey West stated in Scale: The Universal Laws of Life, Growth, and Death in Organisms, Cities, and Companies:

Of the 28,853 companies that traded on U.S. markets since 1950, 22,469 (78 percent) had died by 2009. Of these 45 percent were acquired by or merged with other companies, while only about 9 percent went bankrupt or were liquidated; 3 percent privatized, 0.5 percent underwent leveraged buyouts, 0.5 percent went through reverse acquisitions, and the remainder disappeared for “other reasons.”

That’s why if a particular stock is down big from their all time highs (as many of the stocks are these days), we can only hope that they will come back to those levels. It’s possible that these companies might just keep going all the way down to 0, but for an index, it’s so much more likely that it would come back to its all time highs as it has in the past due to its self-cleansing nature.

2. The odds are stacked against me when it comes to beating the index

While it can be very tempting to try to outperform the performance of a benchmark index such as S&P 500, it is very very hard. There are fund managers who have the full time job of analyzing and picking stocks which can outperform the index, but even a majority of them are not able to do it, at least not consistently enough. The statistics show 85% of large-cap active managers didn’t beat the S&P 500 over decade ending 2019. If even with so many more resources and time spent on it, a vast majority of them are struggling, then my chances are realistically slim anyway. Sure, there are some investors who are able to do it consistently and are good at picking stocks which outperform the index, I have realized that my time is better spent elsewhere. It’s possible to become the next Warren Buffet but I have realized it’s at least not going to be me. As Morgan Housel writes in the book Psychology of Money, “I can afford to not be the greatest investor in the world, but I can’t afford to be a bad one”.

3. It’s mentally draining

This is perhaps the biggest reason I have found personally. After being relatively heavily invested in a few stocks, I have found myself to be much more emotionally attached to their performance. I would find myself waiting for them to report their quarterly earnings, reading their reports in detail, following all news related to them. If I found an article or a reddit post claiming that this stock is going down or it’s a sinking ship, I would tend to go on reddit forums/youtube videos/other news articles to get counter evidence. If constantly, they are reporting lower earnings, I would question why I invested in them in the first place. I was finding this very taxing. Therefore, I have found the approach of steadily investing some amount every month in index funds quite freeing in that sense.

I still own some individual stocks that I invested in. I would want to get out of them too once they recover (if they do!). But going forward, I want to invest most of my investing money in index funds. It means that I would probably never be able to place bets like Jason DeBolt, but hopefully, it would also prevent me from situations like this:

But to each their own.